If you’ve ever asked someone how to build credit, you may have heard this line (I have!): “You need to carry a balance on your credit card to improve your credit score.”

It sounds logical at first. After all, if lenders want to see you “using credit,” wouldn’t leaving a balance show them you’re responsible? But here’s the truth: carrying a balance does nothing to help your credit score, and it usually hurts you.

Let’s break down why this myth persists, what really matters for your credit score, and how you can play the game the smart way.

What Credit Scores Actually Measure

Credit scores are designed to measure risk…specifically, how likely you are to pay back borrowed money. They’re not measuring whether you’re “good” or “bad” with money, but rather how predictable you are as a borrower.

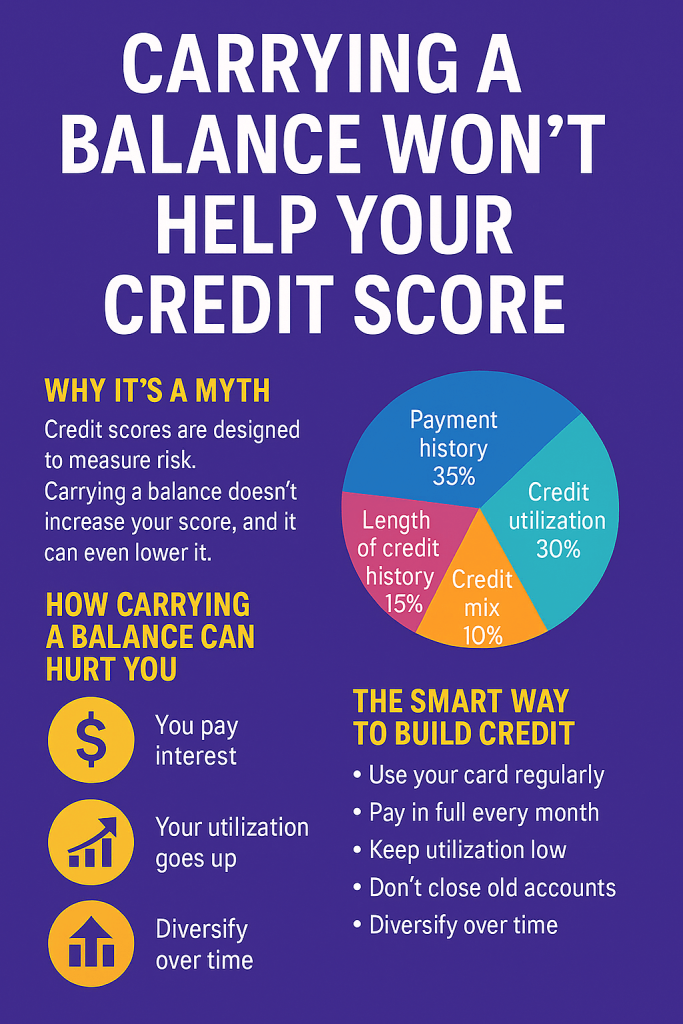

The main factors are:

- Payment history (35%): Do you pay on time?

- Credit utilization (30%): How much of your available credit are you using?

- Length of credit history (15%): How long have your accounts been open?

- Credit mix (10%): Do you have different types of credit (cards, loans, mortgages)?

- New credit (10%): How often do you apply for new accounts?

Notice what’s missing? Carrying a balance. It’s not part of the formula.

Why Carrying a Balance Hurts Instead of Helps

When you leave a balance on your card, two things happen:

- You pay interest. Even if it’s just a few hundred dollars, interest charges add up quickly. A $1,000 balance at 20% APR costs you $200 a year if you don’t pay it off. That’s money straight out of your pocket.

- Your utilization goes up. Utilization is the percentage of your available credit you’re using. If you have a $5,000 limit and carry a $2,000 balance, that’s 40% utilization. Lenders prefer to see this below 30%, ideally below 10%. Higher utilization can drag your score down.

So not only does carrying a balance fail to boost your score, it can actively lower it while costing you money.

Why the Myth Persists

There are a few reasons people keep repeating this bad advice:

- Confusion between “using credit” and “carrying debt.” You do need to use your credit card to build credit, but that just means making purchases and paying them off.

- Misunderstanding of utilization. Some think leaving a balance shows activity. In reality, activity is shown by transactions, not debt.

- Anecdotal stories. Someone might say, “I carried a balance, and my score went up.” In truth, their score improved because of other factors (like paying on time or lowering utilization elsewhere).

The Smart Way to Build Credit

If carrying a balance isn’t the answer, what is? Here’s how to build and maintain a strong score without wasting money on interest:

- Use your card regularly. Buy groceries, gas, or everyday items.

- Pay in full every month. This shows lenders you can manage credit responsibly while avoiding interest.

- Keep utilization low. Even if you spend $1,000 a month, paying it off before the statement closes keeps your reported balance low.

- Don’t close old accounts. Length of history matters, so keep older cards open even if you rarely use them.

- Diversify over time. A mix of credit types (like a car loan or mortgage) helps, but don’t rush into debt just for variety.

A Surprising Angle: Why Zero Balances Can Still Be Powerful

Here’s something most people don’t realize: you can have a zero balance and still show “activity” to the credit bureaus.

Credit card companies report your balance at the end of each billing cycle. If you used your card during the month and then paid it off, the report still shows activity even if the balance is zero at the time the statement closes.

That means you can build credit history, demonstrate responsible use, and keep utilization low all at once. Carrying debt is completely unnecessary.

Real-Life Example

Imagine two friends, Alex and Jordan.

- Alex believes the myth. He carries a $1,000 balance on his $5,000 card, thinking it helps his score. His utilization is 20%, and he pays $200/year in interest.

- Jordan uses the same card for $1,000 in monthly purchases but pays it off in full. His utilization is reported as near zero, his score stays strong, and he pays no interest.

Both are “using credit,” but Jordan is playing the game smarter, and Alex is building debt.

The Answer is Clear: No

Carrying a balance on your credit card is not only unnecessary for building credit, but it’s also harmful. It costs you money in interest and can lower your score by raising utilization.

The real keys to a strong credit score are simple: pay on time, keep utilization low, and use credit responsibly. That’s it. No tricks, no debt required.

So the next time someone tells you to leave a balance, you can confidently say: “That’s a myth. I’ll build my credit without paying a dime in interest.”