Private school tuition can feel like a noble investment in your child’s future. But before you commit to $25,000 a year—or more—it’s worth asking a deeper question:

Can you truly afford it?

Not just “Can we make the payments?” But “Can we absorb the cost without compromising our long-term goals, peace of mind, or financial flexibility?”

Because affording something and absorbing it are two very different things.

The Emotional Pull vs. Financial Reality

Private schools often represent more than academics. It’s about values, community, safety, and opportunity. And when it feels like the “right move,” it’s easy to override the math.

But values don’t cancel out consequences. They work best when paired with clarity.

Before you sign the enrollment forms, take a step back and ask: What does this decision cost—not just in dollars, but in tradeoffs?

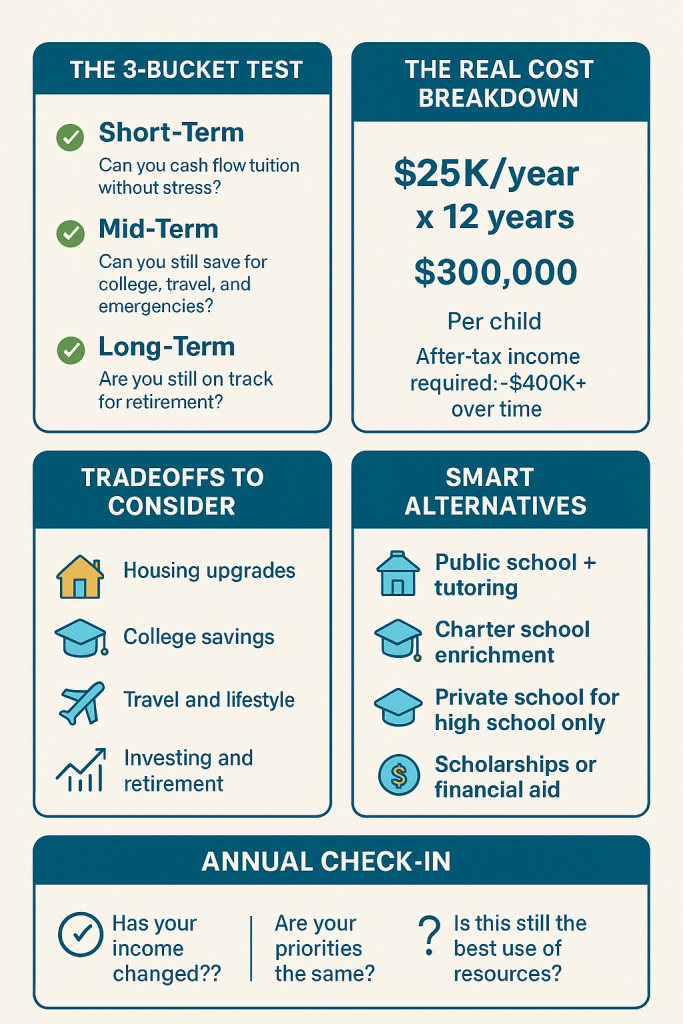

The 3-Bucket Test: A Simple Framework

To evaluate any major expense, especially one as long-term as private school, run it through this filter:

1. Short-Term Viability

Can you cash flow the tuition without stress? If tuition payments force you to dip into savings, rack up credit card debt, or delay basic needs, it’s not sustainable.

2. Mid-Term Flexibility

Can you still save for college, vacations, emergencies, and other goals? Private school shouldn’t crowd out your ability to live a balanced life.

3. Long-Term Impact

Are you still on track for retirement? If tuition payments slow down your investing, delay debt payoff, or reduce your ability to build wealth, the long-term cost may outweigh the short-term benefit.

If private school passes all three buckets, you’re probably in a good spot. If it fails one or two, it’s time to reassess.

The Real Cost of Tuition

Let’s do the math.

$25,000/year × 12 years = $300,000, and that’s per child. After taxes.

For a household earning $180,000/year, that’s a significant chunk of income—especially when you factor in other costs like college, housing, and retirement.

This doesn’t mean private school is off the table. It means you need to be intentional.

What’s the Tradeoff?

Every dollar has a job. If $25K/year goes to tuition, what doesn’t get funded?

- Less travel?

- Smaller home?

- Delayed retirement?

- No help with college?

None of these is a deal-breaker. But they’re real. And they deserve a seat at the table.

Alternatives Worth Considering

If a full-time private school feels tight, consider hybrid options:

- Public school + tutoring

- Charter school + enrichment programs

- Private school for high school only

- Scholarships or financial aid (many private schools offer need-based support)

Sometimes you can get 80% of the benefit at 50% of the cost.

Make It a Renewable Decision

What works this year might not work next year—income changes. Priorities shift. Kids grow.

Treat private school as a renewable decision—not a permanent one. Revisit it annually. Ask: “Is this still the best use of our resources?”