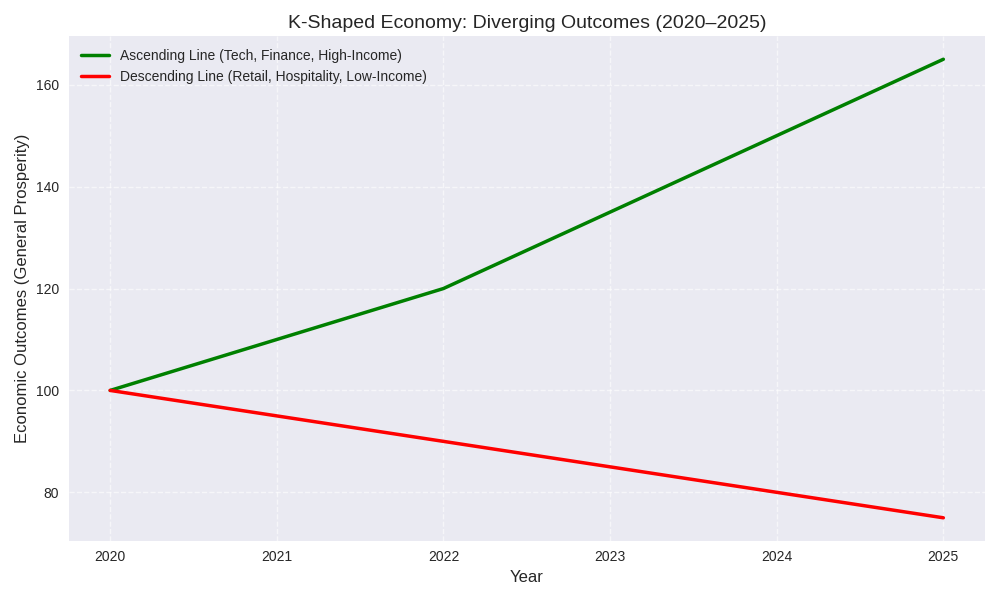

You’ve probably heard people talk about the economy being “V-shaped” or “U-shaped” after a recession. Those letters describe how things bounce back. But lately, economists have been using a different letter: K.

Why K? Because when you look at the letter, one line goes up and the other goes down. That’s exactly what’s happening in parts of the economy. Some people, businesses, and industries are climbing higher than ever.

Others are sliding lower, struggling to keep up.

What Is a K-Shaped Economy?

A K-shaped economy is basically a split recovery. Instead of everyone benefiting when things improve, the gains are uneven.

Some do great. Others? Not so much.

- The upward line: Higher-income households, big corporations, and industries tied to technology, finance, and investments. They see rising wages, growing wealth, and strong demand.

- The downward line: Lower-income households, small businesses, and industries like retail or hospitality. They face slower wage growth, higher costs, and less stability.

So while one group is buying luxury goods and investing in stocks, another group is struggling to pay rent and cover groceries.

Why Does This Happen?

Several factors drive the K-shaped split:

- Technology adoption: Industries tied to AI, data, and digital tools are booming. Jobs in those areas pay more and grow faster.

- Inflation and housing costs: Rising prices hit lower-income families harder because a bigger share of their paycheck goes to essentials.

- Investment markets: Wealthier households own stocks and real estate, which tend to rise in value. Lower-income households often don’t have those assets.

- Education and skills: Workers with advanced skills or degrees often land on the upward line. Those without may struggle to keep pace.

What It Feels Like

If you’re on the upward line, life feels manageable. You can absorb higher grocery bills because your income is rising. You can invest in the stock market and watch your wealth grow.

If you’re on the downward line, it feels like quicksand. Prices rise faster than your paycheck. You don’t have extra money to invest. You’re working hard but not getting ahead.

What You Can Do If You’re Not On the Ascending Line

Here’s the good news: being on the downward line doesn’t mean you’re stuck there forever. There are practical steps you can take to shift your trajectory.

1. Build Skills That Pay

The fastest way to move upward is to increase your earning power. That means learning skills that are in demand.

- Tech skills like data analysis, coding, or AI tools.

- Healthcare certifications, which are always in demand.

- Trade skills like plumbing or electrical work, which pay well and can’t be outsourced.

Think of skills as your personal elevator. The more you learn, the higher you can go.

2. Protect Your Finances

When you’re on the downward line, every dollar matters.

- Cut high-interest debt: Credit cards at 20% interest are wealth killers. Pay them down aggressively.

- Build an emergency fund: Even a few hundred dollars can keep you from sliding deeper when surprises hit.

- Automate savings: Treat savings like a bill you pay yourself first.

3. Own Assets, Even Small Ones

The upward line is fueled by asset ownership — stocks, real estate, and businesses. You don’t need millions to start. On the contrary, starting is how you build millions.

- Use a 401(k) or IRA to invest steadily.

- Buy fractional shares of stock if money is tight.

- Consider side hustles that build equity, like freelancing or small online businesses.

The point is to get your money working for you, even in small amounts.

4. Stay Flexible

Industries change. Jobs disappear. The people who thrive are the ones who adapt.

- Be willing to switch industries if yours is shrinking.

- Keep learning new tools and trends.

- Network with people in growth areas.

Flexibility is your parachute. It keeps you from crashing when the economy shifts.

5. Focus on Habits, Not Headlines

Headlines scream about inflation, layoffs, or market crashes. But your daily habits matter more.

- Spend less than you earn.

- Save consistently.

- Keep learning.

These habits compound over time, just like interest. They move you upward even when the news feels negative.

A Real Example

During the pandemic, tech companies soared while restaurants struggled. That’s a K-shaped economy in action. Workers in tech saw raises and stock options. Restaurant workers faced layoffs and reduced hours.

But some restaurant workers pivoted — they started food trucks, learned digital marketing, or moved into delivery logistics. By adapting, they shifted from the downward line to the upward one.

All Is Not Lost

A K-shaped economy is a split world: some people rise, others fall. It’s not fair, but it’s real.

If you’re not on the ascending line, don’t panic. If you’re a Millennial, don’t worry. You’re not doomed. Focus on what you can control: your skills, your finances, your flexibility, and your habits. Over time, those choices can move you upward.

Remember, the letter K has two lines. You get to choose which one you’re on.