Your emergency fund is your lifeline. If you don’t have money set aside for a rainy day, you’re living your life at risk.

Our emergency fund is money set aside for an unexpected expense.

The significance of an emergency fund lies not merely in its financial cushion but in its power to safeguard against the crippling effects of job loss, medical emergencies, natural disasters, and unexpected setbacks that can upend lives in an instant.

It’s a myth that you don’t need an emergency fund if you’re rich, too.

This financial safety net is a testament to prudence and preparedness, a means to reclaim a semblance of control when circumstances threaten to spiral into chaos. Without an emergency fund, individuals navigate a precarious tightrope, one misstep away from financial catastrophe.

It is money that we can use in an emergency situation to help live our lives, save our lives, or make our lives just a bit easier.

For example, emergency funds are used for:

✅ unexpected job losses

✅ sudden medical expenses

✅ home or car repairs from accidents

✅ bail money?

However, that money is NOT designed to be used to buy that television you’ve always wanted that just went on sale.

This money is for emergencies and will only work if we are honest with ourselves and resist stealing from it to buy non-essential things.

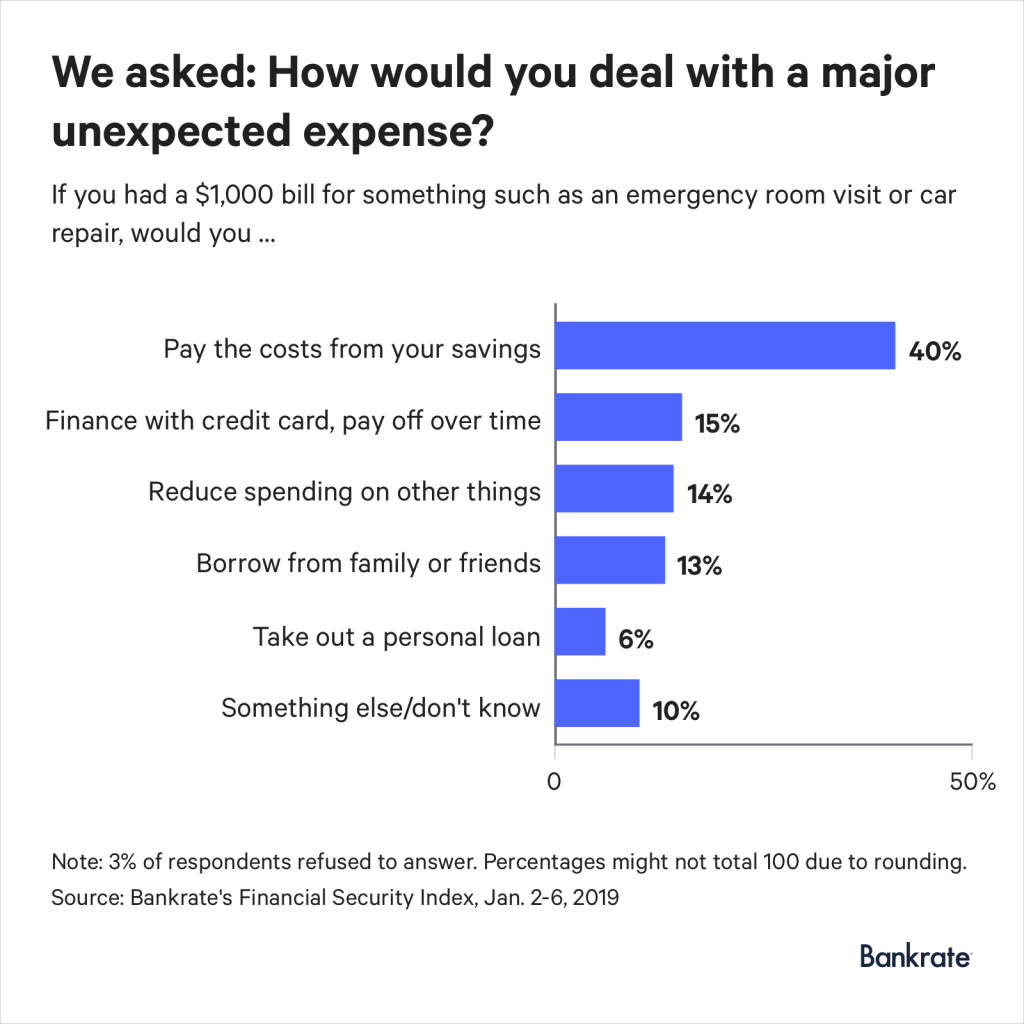

According to a Bankrate survey, Americans are largely unprepared for an emergency. Less than half of those surveyed said they could pay a $1,000 emergency from savings. Most would need to finance the expense, reduce spending elsewhere or borrow from friends or family.

In any way that you slice it, this is a problem. It means that too many of us are living with risk. The risk of something going wrong.

If you don’t have an emergency fund, start one today.

5 Ways To Build An Effective Emergency Fund

Saving for a rainy day is an essential part of living a money-conscious life. The more we have saved, the more we will be able to endure if things get tough.

Here are five of the best ways to build your rainy day fund.

1. Separate your emergency fund from checking

Resist the temptation to save your emergency fund directly in your main checking account. Why? Because that money will be far too easy to spend if it’s housed with everything else.

Like storing chocolate in our pantry: If it’s there, we will be tempted to take a piece! Let’s not tempt ourselves.

Instead, physically separate your emergency fund into a different account.

We use an Ally savings account for our emergency fund.

We earn a small amount of interest on the money and it’s impossible to accidentally spend because that money is completely separated from our primary checking account. But, that money is also easy to access when we need it for unexpected expenses and emergencies.

2. Aim to save 6 months of living expenses

Traditionally, 3 to 6 months is what most financial advisors recommend to save in your emergency fund. For example, if you typically spend $2,000 a month to live (including rent, insurance, food…everything), then you would need to save up between $6,000 and $12,000 in your emergency fund.

✅ $6,000 would get you through 3 months.

✅ $12,000 would support you for 6 months.

I always recommend 6 months. As the coronavirus-inspired pandemic has clearly proven, we never know when an emergency will happen, and the smartest strategy is to be as prepared as possible.

3. Start saving as much as you can

If you have no emergency fund (or just a small fund), it can be tough to think about saving six months of living expenses.

Remember that emergency funds are not built in a day.

It took my wife and me several years to build up our rainy day fund, which is close to three years of living expenses.

Note: Saving up three years is certainly not required. We purposely went overboard. As I said before, aim for 6 months of living expenses.

If you can only save $5 a week for a while, then do that. That’s okay.

Start with whatever you can, then slowly increase that amount as you make more money (or reduce your expenses). This isn’t a race.

The key element here is to start. Open up a separate bank account, then slowly begin adding money to that account.

4. Make it your priority

I believe that building a solid emergency fund is more important than investing or paying off debt. Remember that emergencies cause debt.

They destroy wealth. And, the more prepared we are to withstand an unexpected expense or job loss financially, the better our chances of pulling through without incurring credit card debt.

If you cannot easily cover a $1,000 emergency without using a credit card or borrowing money, make your rainy day fund your #1 priority.

5. Make it automatic

Lastly, I am a huge fan of financial automation.

Automation takes discipline out of the equation by setting up automated routines that will help us build our emergency fund. And most banks offer online systems that let us easily set up recurring monthly transfers.

For example, one strategy could involve setting up a recurring monthly transfer of $50 from our primary checking account into our separate savings account that houses our emergency fund. That means every month, the bank automatically transfers that money.

The automated system will never forget. Set it up once, then forget it.