$1.13 trillion. That’s the total amount of credit card debt Americans shoulder in the U.S. It’s also one of the worst types of debt because it’s high-interest and extremely difficult to escape. Fortunately, there are two proven methods to help you murder that debt.

If you have bad debt, eliminating it should be your #1 priority.

Why Is Debt Elimination Important

Eliminating bad debt is important because it will drastically improve your financial health. Bad debt is like a little monster that keeps eating away at your money, making it hard to save or spend on things you want or need.

You pay more interest fees when you have bad debt, like high-interest credit card debt or loans you can’t afford. That means you’re throwing away your hard-earned cash without getting much in return.

Plus, bad debt, like your financial report card, can affect your credit score. A bad credit score can make it tough to get loans in the future, like for a car or a house, or even for simple things like getting a phone plan.

There is nothing good about bad debts.

Good Debt vs. Bad Debt

Believe it or not, all debts aren’t bad. Yes, credit card debt and other high-interest obligations are bad, but that doesn’t mean some debts aren’t good.

Good debt is when you borrow money to invest in something that can help you in the long run, like buying a house or getting a college degree in a marketable career. These things can increase in value or help you earn more money.

Bad debt, on the other hand, is when you borrow money for things that don’t help you in the long term and might even lose value over time. Examples include using a credit card to buy clothes or going on a vacation you can’t afford.

In simple terms, good debt is when you borrow money for things that can benefit you in the future, while bad debt is when you borrow money for things that won’t help you in the long run and will worsen your financial situation.

Now, let’s talk about the two primary types of debt relief strategies.

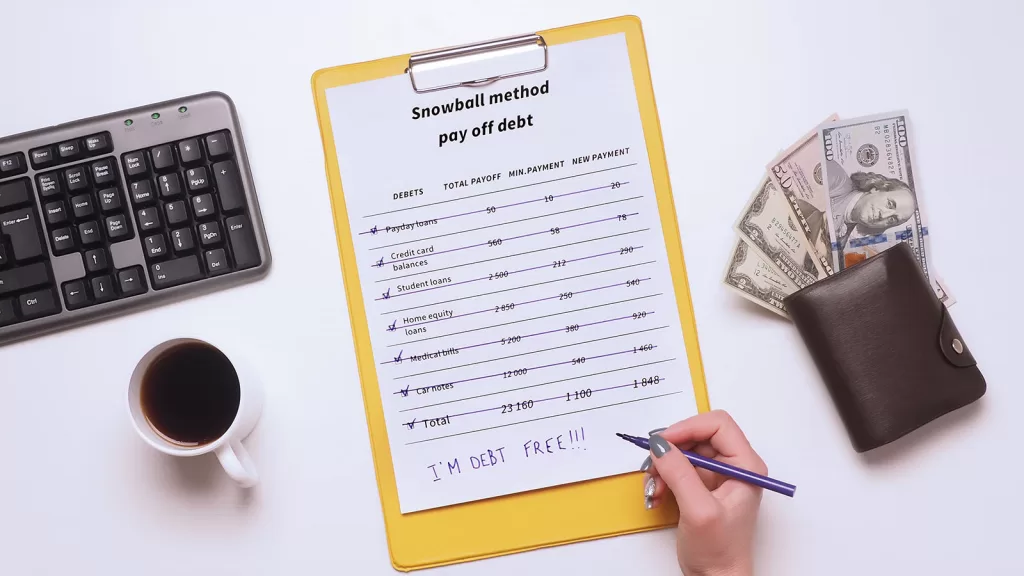

Debt Snowball

A favorite of popular talk radio host Dave Ramsey, the debt snowball method is a way to pay off your debts faster and stay motivated.

Here’s how it works:

- List Your Debts: First, list all the debts you owe, like credit cards, loans, or medical bills. Write down the amount you owe for each debt and the minimum monthly payment.

- Order Your Debts: Next, put your debts in order from smallest to largest based on the amount you owe. Don’t worry about the interest rates for now.

- Pay Minimums Except the Smallest Debt: Keep making the minimum payments on all your debts except the smallest ones. For the smallest debt, try to pay as much extra as you can afford each month to kill that debt first.

- Celebrate Each Victory: Once you’ve paid off the smallest debt, celebrate your achievement! It might be a small victory, but it is a step closer to being debt-free.

- Snowball the Payments: Now, take the money you were paying on the smallest debt and add it to the minimum payment of the next smallest debt. Keep doing this until all your debts are paid off.

Here’s an example to make it clearer.

Let’s say you have three debts:

- Credit Card: $500 (minimum payment $25)

- Personal Loan: $1,000 (minimum payment $50)

- Student Loan: $2,500 (minimum payment $100)

You focus on paying off the credit card first because it’s the smallest debt. You pay $100 extra on the credit card each month, so you’re paying $125 instead of just $25.

After a few months, you’ve paid off the credit card debt. Now, you add the $125 you were paying on the credit card to the minimum personal loan payment. So instead of paying just $50 for the personal loan, you’re now paying $175 ($125 + $50).

You keep doing this until all your debts are paid off. Each time you pay off a debt, you have more money to put towards the next one, like a snowball rolling down a hill, getting bigger and stronger each turn.

Remember, the key is to stay committed and keep going. It might take time, but you’ll eventually become debt-free with the debt snowball method!

Debt Avalanche

The debt avalanche method is similar to the snowball method. The biggest difference is that it prioritizes each debt by interest rate, not size.

Here’s how it works:

- List Your Debts: First, list all your debts, such as credit card balances, student loans, or car loans. Write down the amount you owe and the interest rate for each debt.

- Order Your Debts: Arrange your debts from the one with the highest interest rate to the one with the lowest interest rate. This is important because you want to focus on paying off the debt that’s costing you the most money first.

- Pay Minimums, Plus Extra: Keep making the minimum payments on all your debts to avoid penalties. But, with the debt at the top of your list (the one with the highest interest rate), pay as much extra as you can afford each month.

- Repeat Until Debt-Free: Once you’ve paid off the first debt, take the money you were paying toward it (the minimum payment plus the extra amount) and apply it to the next debt on your list. Keep repeating this process until you’ve paid off all your debts.

Here’s an example.

Let’s say you have three debts:

- Credit Card A: $5,000 balance with a 20% interest rate.

- Student Loan B: $10,000 balance with a 6% interest rate.

- Car Loan C: $15,000 balance with a 4% interest rate.

Using the debt avalanche method, you’d focus on paying off Credit Card A first because it has the highest interest rate. You make the minimum payments on Student Loan B and Car Loan C, but you put as much extra money as possible toward Credit Card A. Once Credit Card A is paid off, you take the money you paid toward it and apply it to Student Loan B. Then, when Student Loan B is paid off, you tackle Car Loan C.

This method helps you save on interest over time because you’re paying off the debts with the highest interest rates first. Plus, as you pay off each debt, you free up more money toward the next one, creating a snowball effect that helps you become debt-free faster.

Which One Should You Choose?

Choosing between the debt snowball and debt avalanche methods depends on your preferences and financial situation. Either method works great, and it is important to pick and stick with it.

You can’t afford to live your life in debt – literally.

Here’s a simple breakdown to help you decide:

- Debt Snowball:

- This method focuses on paying off your smallest debts first, regardless of interest rates.

- You start by paying off the smallest debt while making minimum payments on the others.

- Once the smallest debt is paid off, you move on to the next smallest debt, and so on.

- The idea is to gain momentum and motivation by quickly eliminating smaller debts, even with lower interest rates.

- Debt Avalanche:

- This method prioritizes paying off debts with the highest interest rates first.

- You make minimum payments on all debts but put any extra money towards the debt with the highest interest rate.

- Once the highest-interest debt is paid off, you move on to the next highest-interest debt, and so forth.

- The debt avalanche can save you more money on interest payments in the long run because you’re tackling the most expensive debts first.

How to Decide:

- Consider Your Personality: If you need quick wins and motivation, the debt snowball might be more appealing because you’ll see debts disappear sooner. But if you’re motivated by saving money on interest in the long run, the debt avalanche might be a better fit.

- Look at Your Debts: Analyze the interest rates and amounts of your debts. The choice might be easier if your smallest debt has the highest interest rate. But if there’s a big gap between interest rates and debt sizes, you might need to weigh the emotional benefits of the snowball method against the financial benefits of the avalanche method.

- Evaluate Your Cash Flow: Consider how much extra money you can put towards monthly debt. The snowball method might provide more flexibility if you have a tight budget because you’ll free up minimum payments faster. But if you have a larger amount to dedicate to debt repayment, the avalanche method can save you more money over time.

Ultimately, there’s no one-size-fits-all answer.

Both methods can help you become debt-free; it’s just a matter of choosing the one that aligns best with your goals, personality, and financial situation.