There’s a persistent myth in our culture: that millionaires are born, not made. That wealth is mostly a matter of luck, family connections, or a golden inheritance. It’s an idea that can feel comforting—if you’re not wealthy, it’s because you weren’t born into the right family. But the data tells a very different story.

The truth is that most millionaires don’t inherit their wealth—they earn it.

Understanding this distinction is super important, as it reshapes how we think about opportunity, discipline, and the path to financial independence.

The Myth of the Silver Spoon

Surveys show that many Americans believe wealth is inherited. A Ramsey Solutions study found that 74% of millennials think millionaires inherited their money, and even 52% of baby boomers feel the same.

But when researchers actually studied over 10,000 millionaires, the results were striking:

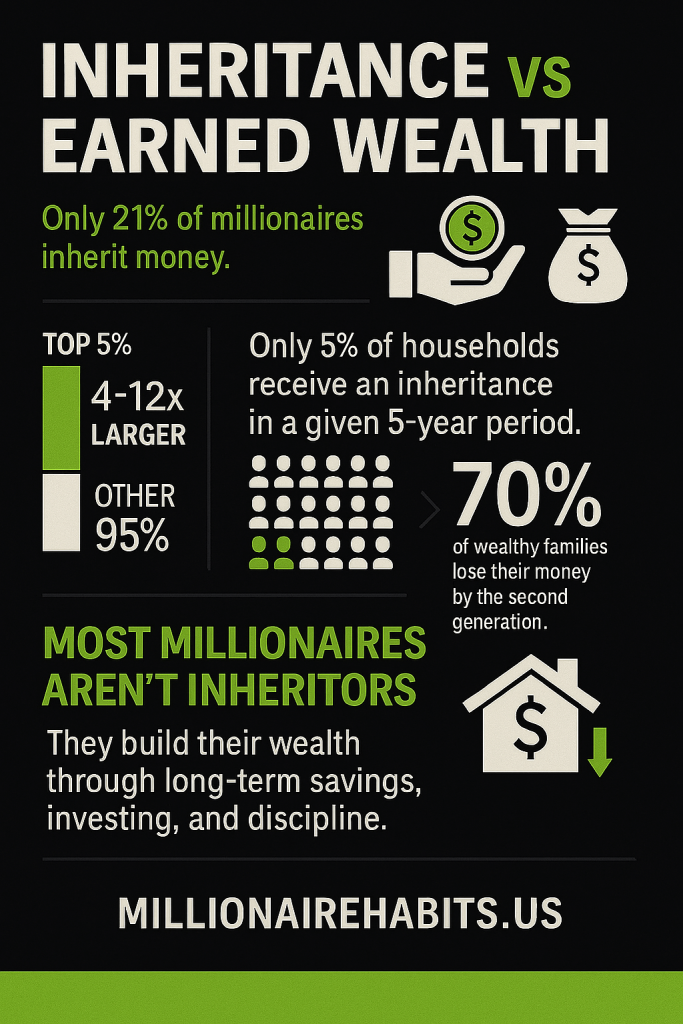

- Only 21% of millionaires received any inheritance at all.

- Just 16% inherited more than $100,000.

- And only 3% inherited $1 million or more—hardly enough to explain the vast majority of millionaire households.

In other words, the overwhelming majority of millionaires didn’t get rich because of family wealth. They got rich because of habits, discipline, and long-term financial choices.

What the Penn Wharton Study Reveals About Inheritances

The Penn Wharton Budget Model (PWBM) study on inheritances by age and income group provides a deeper look at how wealth is actually passed down in America.

Here are some of the most important findings:

- Inheritances are concentrated among the wealthy. Households in the top 5% of income receive inheritances 4 to 12 times larger than those in the bottom 80%.

- Most inheritances happen in midlife. The peak age for receiving an inheritance is between 46 and 75, with the median inheritance for ages 56–65 around $19,800.

- Few people inherit at all. Only about 5% of households receive an inheritance in any given five-year period.

- Conditional amounts are much larger. Among households that do inherit, the bottom 90% typically receive between $90,000–$158,000, while the top 5% average $424,000.

What does this mean? Inheritances are real, but they’re not universal.

They’re skewed toward the wealthy, they arrive late in life (often after age 50), and they’re not nearly as transformative as people imagine.

If you’re waiting for an inheritance to make you wealthy, you’ll likely be waiting a long time—and for most people, it will never come.

The Self-Made Millionaire

So if inheritances aren’t the primary driver of wealth, what is? The data points to a few consistent themes:

- Long-term saving and investing. The majority of millionaires build wealth slowly, through consistent saving and investing. Fidelity Investments found that 88% of millionaires are self-made, and most accumulated wealth through retirement accounts, stock ownership, and disciplined saving.

- Living below their means. Thomas Stanley and William Danko’s classic study The Millionaire Next Door revealed that most millionaires don’t live flashy lifestyles. They drive modest cars, live in average neighborhoods, and prioritize financial independence over status symbols.

- Education and career discipline. Millionaires are often professionals—engineers, teachers, managers, small business owners—who steadily advanced in their careers and avoided lifestyle inflation.

- Avoiding debt. Self-made millionaires tend to avoid high-interest debt, particularly credit cards. They use debt strategically (like mortgages or business loans) but not recklessly.

Why Inheritance Isn’t a Golden Ticket

Even when people do inherit money, it doesn’t guarantee wealth. Studies show that one-third of people who receive an inheritance see no long-term improvement in their financial situation—and in some cases, their wealth actually declines afterward.

Why? Because money without financial literacy is fragile. Without the habits of saving, investing, and discipline, inheritances can vanish quickly.

This is why so many wealthy families lose their fortunes within a few generations. Research shows that 70% of wealthy families lose their wealth by the second generation, and 90% by the third. Inheritance without stewardship doesn’t last.

The Billionaire Exception—and Why It’s Different

It’s worth noting that at the very top—the billionaire class—inheritance plays a larger role. A 2023 UBS report found that for the first time, more billionaire wealth was created through inheritance than entrepreneurship.

But billionaires are the extreme outliers. For the vast majority of millionaires—the doctors, small business owners, engineers, and teachers who quietly build seven-figure net worths—inheritance is not the story. Hard work, discipline, and time are.

Why This Matters

The myth of inherited wealth is dangerous because it discourages people. If you believe millionaires are only born into it, you might think: Why bother? But the data shows the opposite: wealth is accessible to those who practice consistent, disciplined financial habits.

- You don’t need a trust fund.

- You don’t need a windfall.

- You don’t need to be born into the “right” family.

What you need is time, patience, and the willingness to live below your means while investing consistently.

Practical Lessons from the Data

So what can we learn from all this research?

- Don’t wait for an inheritance. Statistically, it’s unlikely to come—and if it does, it will probably arrive later in life and be smaller than you expect.

- Focus on what you can control. Your savings rate, your spending habits, and your investment strategy matter far more than family wealth.

- Build financial literacy. Even if you do inherit, knowledge is what preserves and grows wealth. Without it, money slips away.

- Play the long game. Most millionaires didn’t get rich quick. They got rich slow—through decades of steady, intentional choices.

Conclusion: The Real Path to Wealth

Inheritance is free. Denial is free. But only one builds wealth—and it’s not waiting for a check from your parents.

The overwhelming majority of millionaires are self-made. They didn’t rely on luck or family money. They relied on discipline, patience, and the power of compounding.

The Penn Wharton study shows that inheritances are rare, concentrated, and often modest. The Ramsey Solutions study shows that only a small fraction of millionaires inherited significant wealth. And decades of research show that wealth built on habits lasts far longer than wealth built on windfalls.

So if you want to build wealth, don’t wait for an inheritance. Start tracking your spending. Start saving. Start investing. Start today.

Because the real secret isn’t being born into money. It’s becoming the kind of person who knows how to build it.