Like Rome, wealth isn’t built in a day.

Most take decades to amass enough wealth to achieve financial independence – the point where you have enough money where full-time work becomes optional. Wealth is built on a timeline.

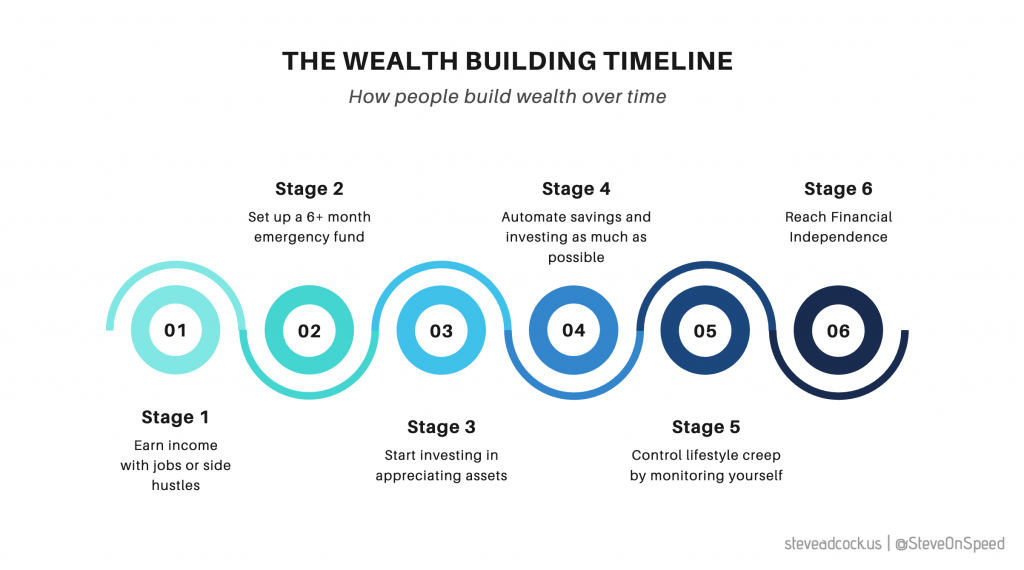

That timeline looks something like this:

Note that this timeline might look different for some people, but it generally includes the key stages of building wealth over the course of a lifetime.

The Wealth Building Timeline

Stage 1: Earn income with jobs or side hustles. Unless you’re the fortunate beneficiary of a large inheritance, it’s impossible to build wealth without earning an income. The larger the income, the more growth potential.

Note that you don’t need to earn a big salary to achieve financial independence or retire early, though it will take longer to build wealth with smaller salaries. That’s okay. This is a process, not a race.

Stage 2: A 6+ month emergency fund. Building an emergency fund should come before investing – and definitely before spending on things that are not essential to your life. An emergency fund of at least six months means you can endure most financial emergencies, sudden job losses or anything else that necessitates a quick and big cash expense.

If you don’t have an emergency fund, start one today. Start small. Save as much as you can. The key is to start building it NOW.

Stage 3: Start investing in appreciating assets. Over time, investments are what build wealth. Like I say in my eBook Big Money, there is always a risk associated with investments, but investing over the long haul is how most people build enough wealth to achieve financial freedom.

Stage 4: Automate savings and investing as much as possible. Take discipline from the equation by setting up automatic transfers to fund your investments. This is also a good technique for building up your emergency fund, and most banks offer recurring money transfers.

If your employer offers a 401(k) or IRA, then use the payroll system to contribute to that retirement account automatically.

Stage 5: Control lifestyle creep by monitoring yourself. Be honest with yourself about how you spend your money. Inspect your bank and credit card statements and understand every expense.

Our lifestyles have a way of expanding as we earn more and more money. This process is called lifestyle creep (or inflation), and it eats away at our wealth. This process is not about being judgmental.

It’s about caring enough about your future to reign yourself in.

Stage 6: Financial independence. Congrats, you’re there! But don’t let your guard down. It’s possible to fall out of financial independence if we let our lifestyle get too expensive or extravagant.

How do you know when you’ve reached financial independence?

The Trinity 4% study is one of the best ways to give you a ballpark understanding of your relative “level of independence.” Note that it’s far from perfect, and it should NOT be relied upon as a full-proof guarantee that you’ve reached FI. But I do believe it’s a good guideline.

Building wealth is kind of like growing a sturdy oak tree. It doesn’t happen overnight, and it definitely takes some serious patience.

Think about it: when you plant an acorn, you don’t expect it to turn into a towering tree in a week, right? The same goes for wealth. It’s a gradual process that involves making smart financial choices over time.

Sure, you might hear stories of those overnight successes, but those are like finding a unicorn – rare and magical. For most of us, the real deal is a slow and steady journey.

Picture this: you’re saving and investing your hard-earned money, and it’s like you’re watering that acorn. But instead of rain, you’re feeding it with discipline, consistency, and a bit of delayed gratification. You’re watching it grow bit by bit, just like your wealth.

And yeah, there will be times when you’ll feel like that tree isn’t growing at all, or it’s growing too darn slow. That’s when patience comes into play. Patience keeps you from making impulsive decisions, like digging up the acorn to check if it’s sprouting roots every other day. It’s what prevents you from jumping onto every get-rich-quick scheme that pops up.

So, remember, building wealth is a marathon, not a sprint. It’s the willingness to let time work magic and let your financial acorn transform into that sturdy oak of wealth.