Hang around personal finance gurus long enough, and you’ll hear about some “rules” to help you ballpark how much you can spend on different things.

For instance, the 28/36 rule helps you determine how much you can spend on a home safely.

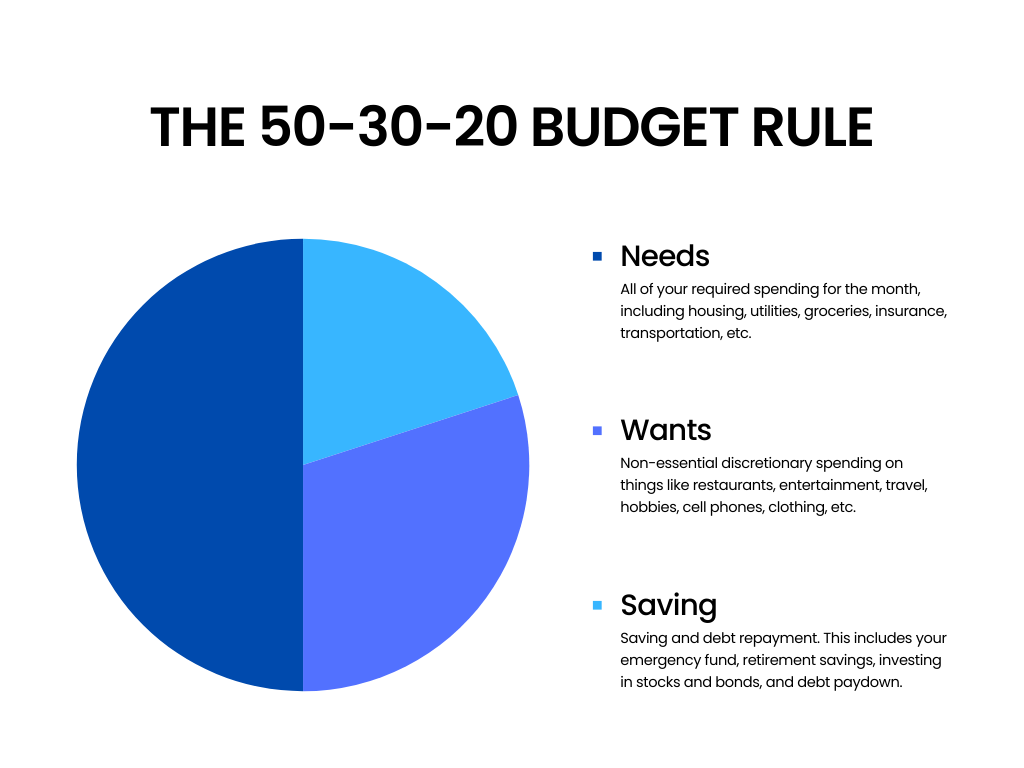

The 50-30-20, on the other hand, is a rule that makes budgeting your money super easy. This rule divides your after-tax income into needs, wants, and savings or debt repayment.

By following this guideline, you can ensure that you live within your means while saving for the future and enjoying life in the present.

Let’s examine how this rule can be applied in real-life scenarios.

The Breakdown of the 50-30-20 Rule

The 50-30-20 breaks down your monthly spending into categories.

50% for Needs

The first category, which accounts for half of your after-tax income, is dedicated to needs. These are essential expenses necessary for survival and maintaining a basic standard of living.

Needs typically include:

- Housing Costs: Rent or mortgage payments, property taxes, and insurance.

- Utilities: Electricity, water, gas, and internet services.

- Groceries: Basic food and household supplies.

- Transportation: Car payments, fuel, public transportation, and insurance.

- Healthcare: Insurance premiums, medications, and necessary medical treatments.

For example, if your monthly after-tax income is $5,000, you should allocate $2,500 to cover these essential expenses. If your needs exceed this amount, you may need to reassess your spending or find ways to reduce costs, such as moving to a more affordable home or cutting down on utility usage.

30% for Wants

Next, 30% of your income is allocated to wants. These are non-essential expenses that enhance your lifestyle and provide enjoyment. In other words, these expenses are discretionary.

Wants can include:

- Dining Out: Restaurants, cafes, and takeout meals.

- Entertainment: Movies, concerts, and streaming services.

- Travel: Vacations and weekend getaways.

- Hobbies: Sports, arts, and other leisure activities.

- Shopping: Clothing, electronics, and other discretionary purchases.

Continuing with the example of a $5,000 monthly income, $1,500 would be set aside for wants. This budget portion allows for flexibility and enjoyment, ensuring you can indulge in activities and purchases that bring happiness without jeopardizing your financial stability.

20% for Savings and Debt Repayment

The final 20% of your income should be directed towards savings and debt repayment. This category is crucial for building financial security and preparing for the future. It includes:

- Emergency Fund: Savings for unexpected expenses like car repairs or medical emergencies.

- Retirement Savings: Contributions to retirement accounts like a 401(k) or IRA.

- Debt Repayment: Paying down credit card balances, student loans, or other debts.

- Investments: Stocks, bonds, or other investment vehicles.

In our example, $1,000 of the $5,000 income would be allocated to this category. Prioritizing savings and debt repayment helps ensure you are prepared for emergencies, can retire comfortably, and reduce financial stress by minimizing debt.

Applying the 50-30-20 Rule

To effectively implement the 50-30-20 rule, start by calculating your after-tax income. Then, categorize your expenses into needs, wants, and savings or debt repayment. Track your spending to ensure you adhere to the budget, and make adjustments as necessary.

For instance, if your “wants” consume more than 30% of your income, consider cutting back on dining out or entertainment. Alternatively, if your needs are too high, explore options like refinancing your mortgage or switching to a more affordable insurance plan.

Or, focus on earning more money through asking for a raise or starting a side hustle.

The 50-30-20 budget rule is a straightforward yet powerful tool for managing personal finances. By allocating your income to these three categories, you can maintain a balanced approach to spending, saving, and enjoying life.

Whether you’re just starting your financial journey or looking to improve your money management skills, this rule provides a solid foundation for financial health and stability.