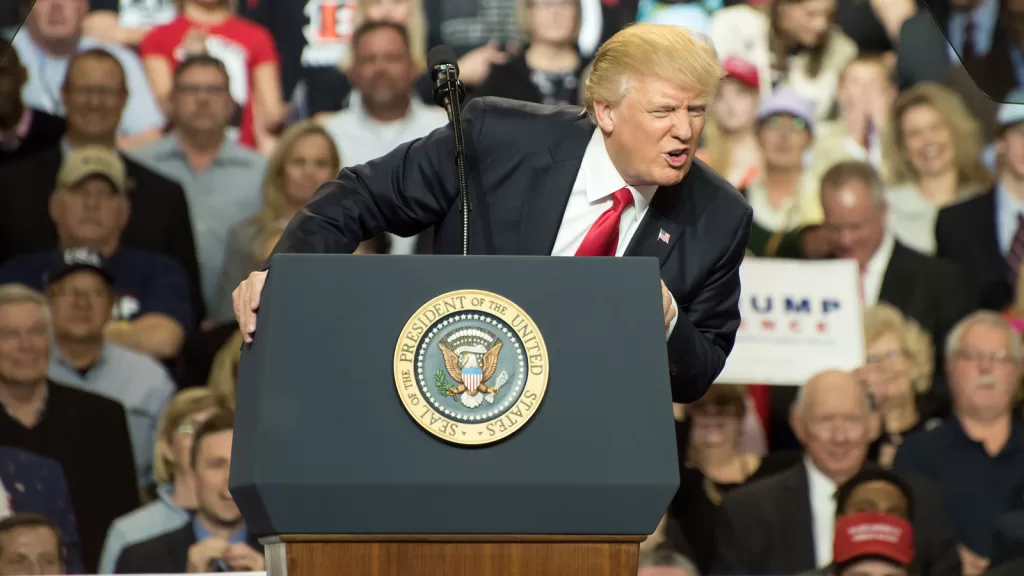

What will happen to your money if Donald Trump wins back the White House in 2024?

Some believe that a Trump presidency would benefit the economy, while others warn that it could negatively affect investors and consumers.

Would a Trump presidency be a good sign for your money?

Here is a look at some of the potential impacts of a Trump victory on your money.

How a Trump Presidency Could Impact Your Money

- Inflation: Trump has repeatedly criticized the Federal Reserve for raising interest rates, arguing that these hikes are unnecessary and harmful to the economy. If Trump wins in 2024, he could pressure the Fed to keep interest rates low, leading to higher inflation.

- Trade: Trump is a protectionist who has imposed tariffs on goods imported from China and other countries. He has also threatened to withdraw the United States from the North American Free Trade Agreement (NAFTA). These policies could lead to higher prices for consumers and businesses and could also make it more difficult for American companies to compete in the global marketplace.

- Taxes: Trump has promised to cut taxes for businesses and individuals. However, some economists believe that these cuts would primarily benefit wealthy Americans and corporations and would do little to boost the economy for the middle class.

- Regulations: Trump has rolled back several regulations on businesses during his presidency. He has also appointed regulators who are sympathetic to his deregulatory agenda. If Trump were to win in 2024, he could continue to roll back regulations, which could benefit businesses and lead to environmental damage and financial risks.

- Foreign policy: Trump has taken a more isolationist approach to foreign policy than his predecessors. He has withdrawn the United States from the Trans-Pacific Partnership trade agreement and the Iran nuclear deal. He has also imposed sanctions on Iran and Venezuela. These policies could lead to higher oil prices and could make it more difficult for American businesses to operate in certain parts of the world.

Overall, the potential impact of a Trump victory on your money is uncertain.

Some experts believe it would benefit the economy, while others warn that it could have negative consequences. It is important to do your research and consult with a financial advisor to determine how a Trump presidency might affect your finances.

In addition to the economic factors mentioned above, there are other potential impacts of a Trump victory on your money.

For example, Trump has repeatedly attacked the media and the judiciary and shown a willingness to use his power to punish his opponents. This could create a more uncertain and volatile environment for investors and businesses, leading to higher risks and lower returns.

Ultimately, the impact of a Trump victory on your money will depend on several factors, including the specific policies he implements and the overall state of the economy. However, it is important to be aware of the potential risks and to take steps to protect your financial interests.

Here are some things you can do to protect your money in the event of a Trump victory:

- Diversify your investments: This means investing in various assets, such as stocks, bonds, and real estate. This will help to reduce your risk if one asset class performs poorly.

- Rebalance your portfolio regularly: This means periodically adjusting your investments to ensure they align with your risk tolerance and financial goals.

- Have an emergency fund: This is a pool of money you can access in the event of an unexpected expense, such as a job loss or medical emergency.

- Stay informed about the economy and financial markets: This will help you to make informed decisions about your investments.

- Consult with a financial advisor: A financial advisor can help you to develop a personalized investment strategy and to protect your money from the risks associated with a Trump presidency.

It is important to remember that no one can predict the future with certainty. However, by taking steps to protect your money, you can reduce your risk and improve your chances of weathering any economic challenges that may come your way.